Market

COPPER MARKET

Over the past decade, the total global copper reserves have increased from 630 million metric tons in 2010 to 880 million metric tons as of 2021. Meanwhile, the total global copper production from mines amounted to an estimated 21 million metric tons in 2021

Electric vehicles need twice as much copper as internal combustion engines

Volume of global copper in electric vehicles

metric tons in 2022

Volume of global copper in electric vehicles

metric tons expected by 2023

GLOBAL COPPER MARKET BY REGION

global copper market was valued at

USD in 2021

expected to grow to

USD by 2030

Sources:

https://www.acumenresearchandconsulting.com/copper-market

https://www.vantagemarketresearch.com/industry-report/copper-in-electric-vehicles-market-1776

https://www.statista.com/topics/1409/copper/#topicOverview

https://www.databridgemarketresearch.com/reports/global-copper-market

LITHIUM MARKET

YOY demand increased

for lithium-ion batteries

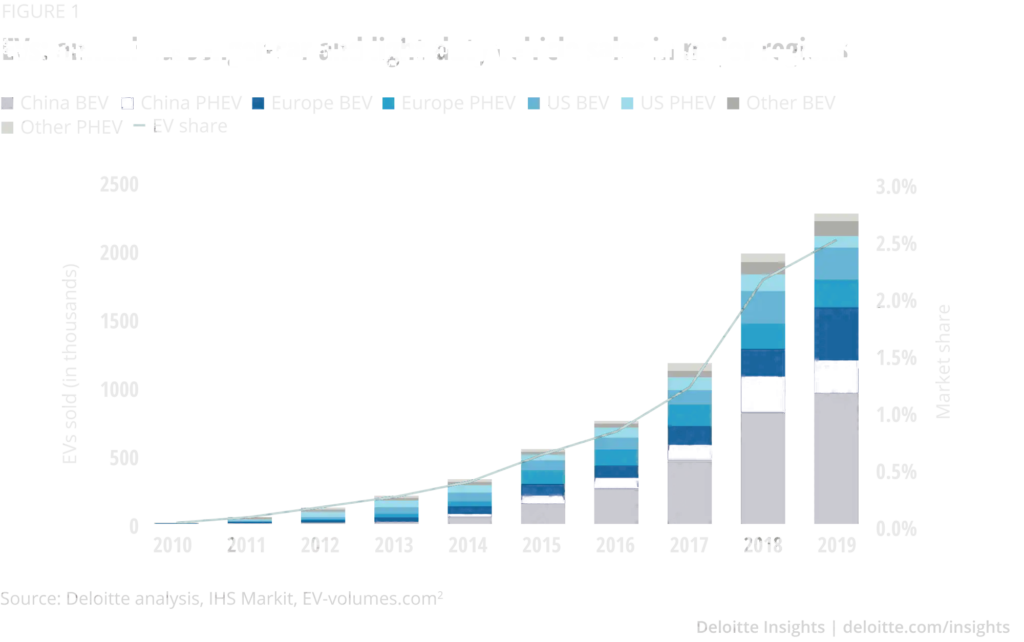

Global EV sales doubled from 3.3M units to

between 2020 and 2021

Global EV sales increased by

in 2022

Facing supply deficit as demand could increase by

in the next decade

Global EV sales doubled from 3.3M units to

Lithium prices have surged

Depending on the method of lithium extraction, bringing new capacity online can take

3-5yrs

or more

Sources: https://www.forbes.com/sites/davidblackmon/2022/05/02/skyrocketing-lithium-prices-highlight-need-for-new-technologies/?sh=4d1cf11db273 | https://www.globalxetfs.com/lithium-market-update-elevated-prices-are-creating-favorable-dynamics-for-miners/

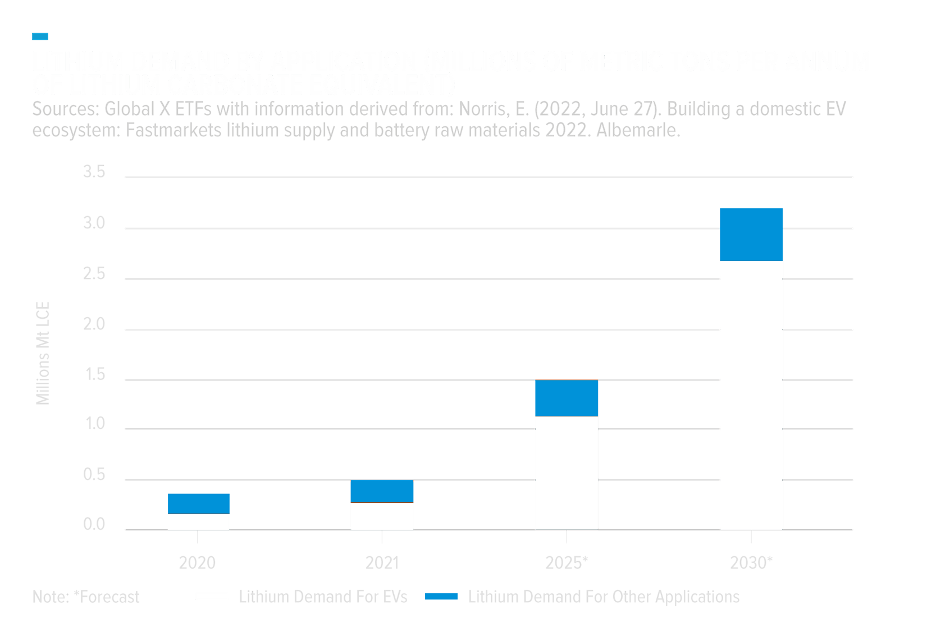

Lithium supply is likely to lag lithium demand through the first half of the decade.

In the short term, notable lithium mining capacity is set to come online in late 2023 and early 2024

These new projects could cut into the deficit in 2023, but surging EV sales are expected to result in sizeable shortages again in 2024 and 2025.

EVs could account for about

of total lithium demand by 2030

up from about

in 2021

Sources: https://www.globalxetfs.com/lithium-market-update-elevated-prices-are-creating-favorable-dynamics-for-miners/

The electric vehicle MARKET

Lithium is one of the key components in EV batteries, but global supplies are under strain because of rising EV demand

of vehicle sales will be EV or hybrid by 2040

EV passenger cars by 2040

barrel demand oil displaced by EVs by 2040

Sources: https://www.woodmac.com/our-expertise1/capabilities/electric-vehicles/2040-forecast/

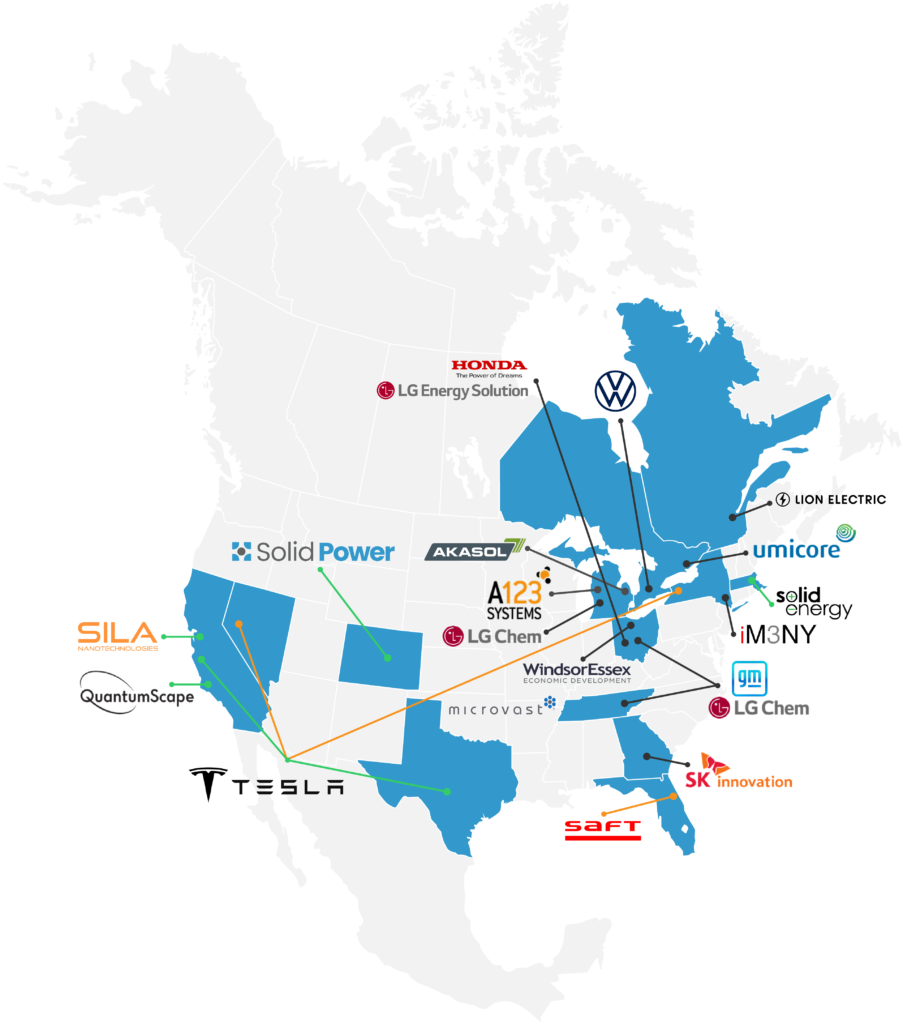

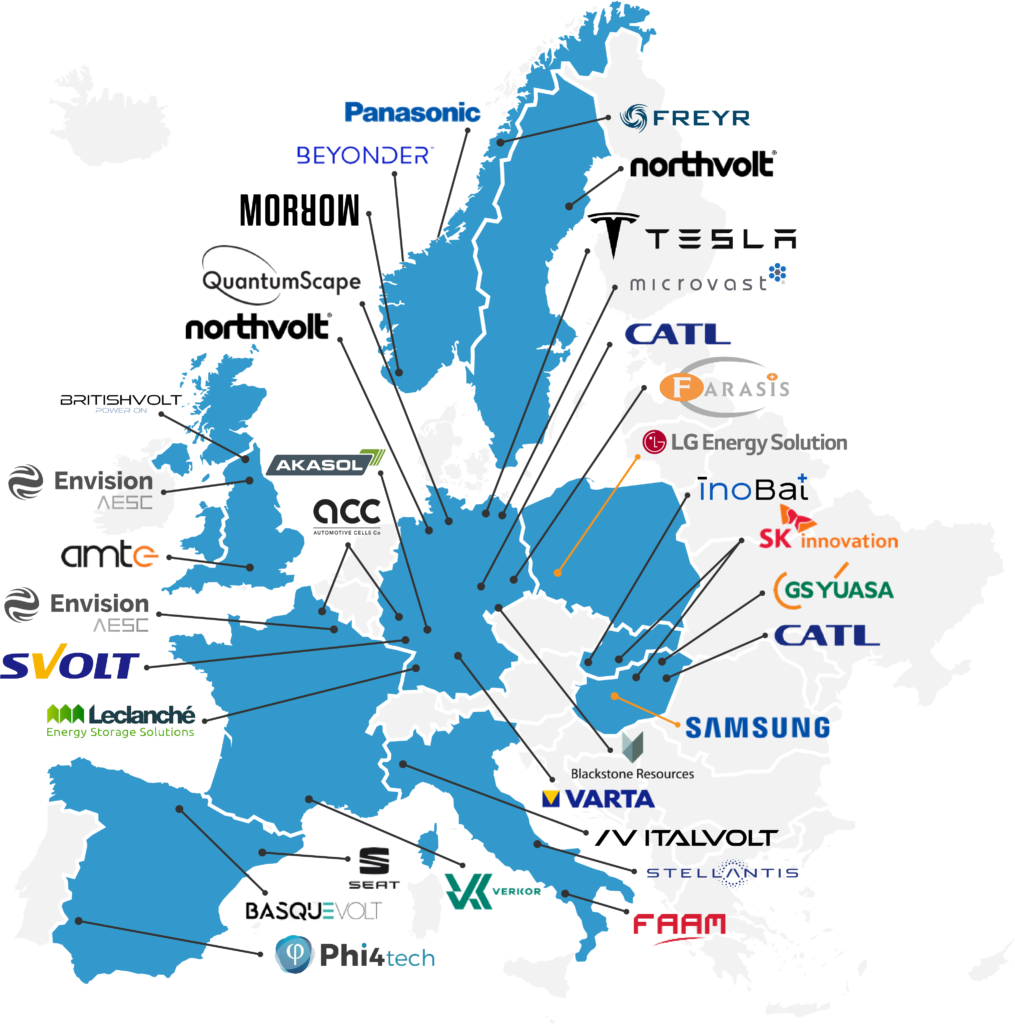

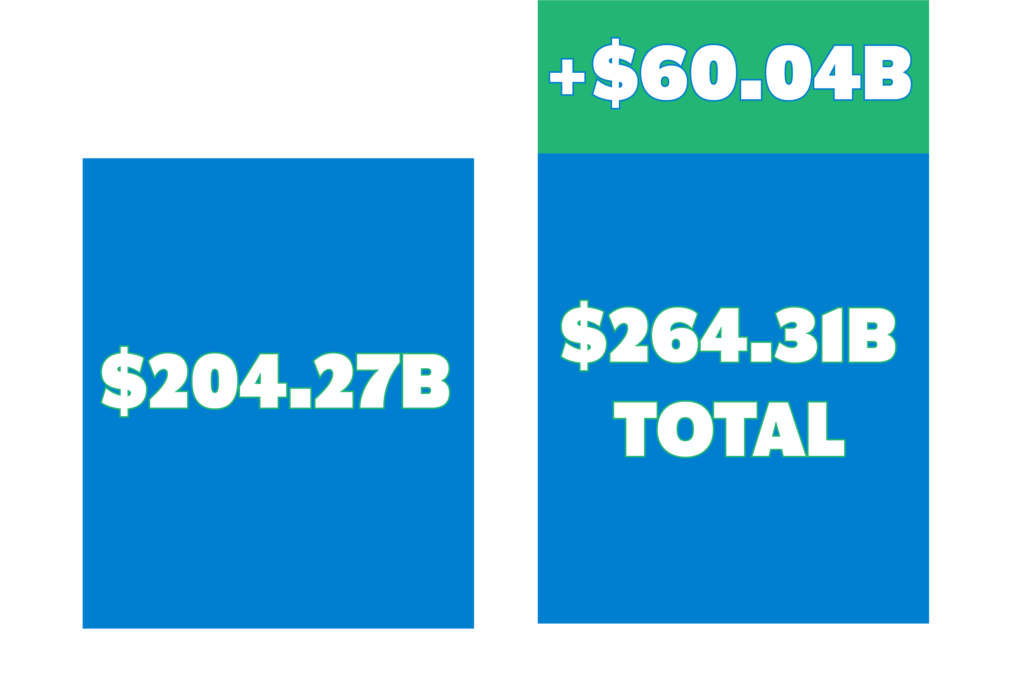

battery plant MARKET

Expected Global Lithium Demand of: 2.7 Mt LCE in 20301

Expected Global EV Battery Demand of: 3.2 TWh in 2030 (~2.5M – 2.9Mt LCE)2

- operational plant

- project in process

- OPERATIONAL PILOT LINE OR IN PROGRESS

Source: IEA

1. Based on IEA’s “The Role of Critical Minerals in Clean Energy Transitions”, May 2021

2. Based on IEA’s “Global EV Outlook 2022”, May 2022. Assuming 0.8 – 0.9kg LCE/kWh

Canada x Volkswagen Battery Plant Deal

Volkswagen announces plans to build a major plant for electric vehicle batteries in St. Thomas, Ontario, Canada

- This will be Volkswagen’s first overseas gigafactory and production is planned for 2027

- The new battery plant could result in adding as many as 2,500 direct jobs and up to 7,500 total indirect jobs

- Canada will contribute to Volkswagen’s battery supply chains through raw materials and assembly

Source: IEA

1. Based on IEA’s “The Role of Critical Minerals in Clean Energy Transitions”, May 2021

2. Based on IEA’s “Global EV Outlook 2022”, May 2022. Assuming 0.8 – 0.9kg LCE/kWh

GOLD MARKET

Gold continues to be the most popular precious metal commodity by offering long-term store of value and serving as a hedge against inflation.

Gold mining is a global industry with operations on every continent except Antarctica.

global gold mining market

Expected CAGR between 2022 and 2027

Gold has been considered one of the best sources of investment for centuries and is always in high demand regardless of any fluctuating economies and happenings in society

Global gold production is expected to surpass

ounces by 2024

Sources:

Gold.org

https://www.researchandmarkets.com/reports/5574847/global-gold-mining-market-2022-edition

https://www.mining-technology.com/gold-commodity-dashboard/