HIGHLIGHTS

- The drill-ready Project is located approximately 10 km west of the currently producing Copper Mountain Mine, which hosts a Proven and Probable Mineral Reserve of 702 Mt of 0.24% Copper.

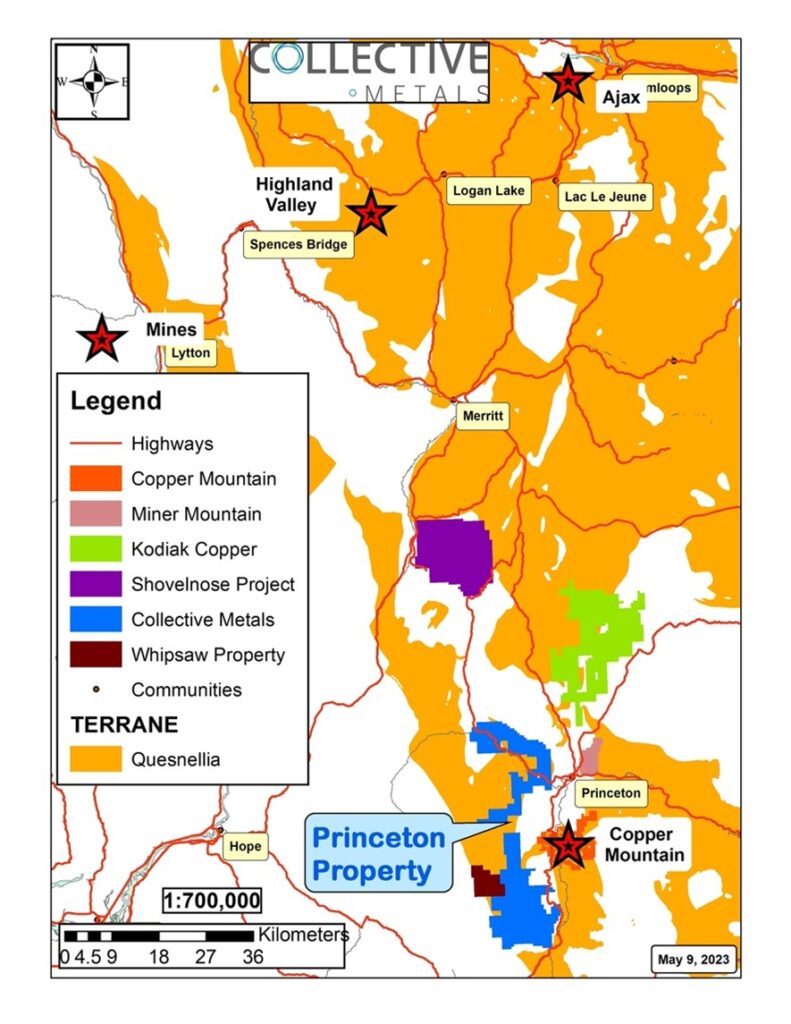

- Upon earning-in under the option, Collective will hold a majority interest in the second largest land package in the area, consisting of 29 mineral tenures totaling approximately 28,560 ha (70,570 acres) in a well-documented and prolific copper-gold porphyry belt.

- Neighbouring peer Kodiak Copper Corp.’s (TSXV: KDK) MPD property recently received a $10.5 million investment by Teck Resources (TSX: TECK.B).

- Copper Mountain was recently acquired by Hudbay Minerals Inc. (TSX: HBM), for CDN $439 million creating the 3rd largest Copper producer in Canada.

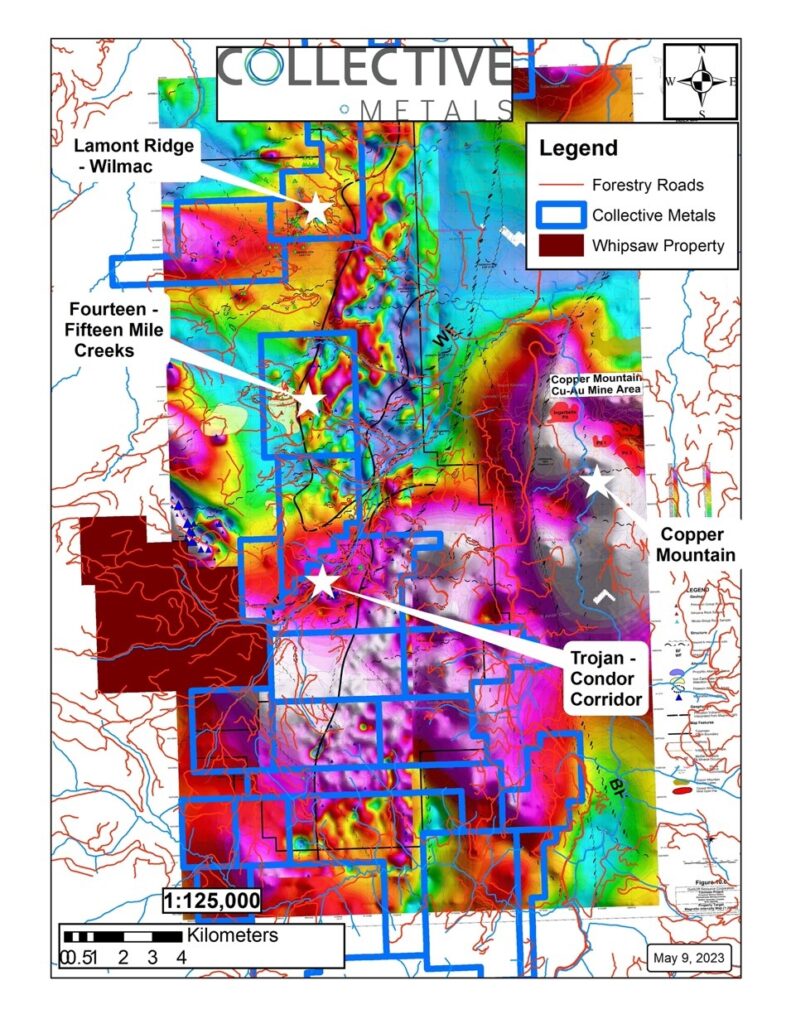

- The predominant feature of interest on the Project is a large, prominent, high intensity magnetic anomaly comparable to the magnetic anomaly spatially associated with the Copper Mountain Mine and associated intrusive complex.

May 10, 2023 – VANCOUVER, B.C. – COLLECTIVE METALS INC. (CSE: COMT | FSE: TO1) (the “Company” or “Collective”), is pleased to announce it has signed an option agreement dated May 9, 2023 to acquire 70% of the Princeton Project (the “Acquisition”), a copper-gold project located in south-central BC covering 70,570 acres (the “Project”) from Tulmeen Resources Corporation (“Tulmeen”). The Project is approximately 10 km west of Copper Mountain Corporation’s (TSX: CMMC) (“Copper Mountain”) currently producing Copper Mountain Mine, which hosts a Proven and Probable Mineral Reserve of 702 Mt of 0.24% Copper. The Project hosts potential for identification of one (or more) copper gold alkalic porphyry occurrences similar in age and deposit type to the Copper Mountain Mine.

The Project is easily accessible by road and is located immediately west of Highway 3 south of Princeton, BC, in a well-established mining district with excellent infrastructure, a local workforce and support services. British Columbia is known as a low-risk jurisdiction with high standards for environmental stewardship and community engagement.

Christopher Huggins, Chief Executive Officer of Collective, commented, “The Acquisition is a major milestone for Collective and gives the Company a drill ready, highly prospective copper project in a world-renowned region. The Company hopes to move quickly to drill high priority targets that have been previously identified from the extensive analysis done on the Project. We believe the Project holds many similarities to the nearby Copper Mountain Mine and has the potential to be developed into a world-class copper gold project.”

Project Overview

The predominant feature of interest on the Project is a large, prominent, high intensity magnetic anomaly comparable to the magnetic anomaly spatially associated with the Copper Mountain Mine and associated intrusive complex. The previously identified Trojan and Nev MINFILE occurrences, together with the geophysically identified Condor Corridor, are located on the northwest margin of the high intensity magnetic anomaly. The Whipsaw Property and the Goldrop MINFILE occurrences, immediately adjacent to the Project and held by competitors, are located on the western and northern margins of the high intensity magnetic anomaly, respectively. Therefore, the high intensity magnetic anomaly will provide the dominant focus for exploration and evaluation of the Project.

The most advanced areas on the Project are as follows:

- The Trojan – Condor Corridor, which is the highest priority drill target on the Project at this time, located on the northwest fringe of the high intensity magnetic anomaly along Whipsaw Creek.

- Magnetite occurrences in the Fifteen Mile, and relatively extensive iron carbonate – silica – pyrite alteration identified in Fourteen Mile Creek drainages, spatially associated with the northwest margin of the high intensity magnetic anomaly.

- The Lamont Ridge and Wilmac target areas, which are also spatially associated with smaller high intensity magnetic anomalies slightly farther to the northwest of the large, high intensity magnetic anomaly.

Based on previous work, the Project has documented potential for precious metals (gold and silver), platinum group elements (predominantly platinum and palladium), base metals (copper, molybdenum, lead and zinc), a variety of industrial minerals, including, but not limited to bentonite, clay, gypsum, pyrophyllite and zeolites) and gemstones (agate). With respect to precious and base metals, there is documented potential for a variety of deposit types defined by BC Deposit Models including, but not limited to Cu ± Mo ± Au Porphyry (L04), Subvolcanic Cu-Ag-Au (As-Sb) (L01), Cu Skarn (K01), Noranda/Kuroko massive sulphide Cu-Pb-Zn (G06) and Polymetallic veins Ag-Pb-Zn+/-Au (I05).

Project Geology

The Project area is underlain by Late Triassic to Early Jurassic Nicola Group volcanic and subordinate sedimentary rocks, overlain on the eastern portion of the property by the Eocene age Princeton Group, a cover sequence that has preserved the underlying Nicola Group from erosion. The Nicola Group was subsequently intruded by Late Triassic – Early Jurassic age diorite intrusions, some of which have been correlated to the Copper Mountain Suite (associated with the Copper Mountain Mine) or the Tulameen Mafic – Ultramafic Complex to the west. Diorite intrusions represent the high priority targets for subsequent exploration and evaluation of the Project area as they are interpreted to potential hosts for porphyry-style alteration and, more importantly, mineralization in the region. Interpreted porphyry-style alteration was identified by previous operators from surface rock samples and sub-surface core samples. The limited drill program carried out on the Project in 2015 also identified weak copper mineralization, as chalcopyrite, also interpreted to indicate the presence of an alkalic copper-gold porphyry.

The Eocene Princeton Group is associated with a distinctly different style of mineralization which includes documented potential for industrial minerals and gemstones (agate). A secondary priority for 2023 is to evaluate volcanogenic massive sulphide (VMS) potential, specifically with respect to the Noranda/Kuroko massive sulphide Cu-Pb-Zn deposit model. A potential VMS exhalate horizon was tentatively identified in work completed by the BC Geological Survey Branch.

Terms of the Option Agreement

Collective has secured an option on the Project from Tulmeen to earn a seventy percent (70%) interest in the Project through a combination of cash payments, common share issuances and incurrence of exploration expenditures, as follows:

(a) paying Tulmeen an aggregate of $500,000 in cash as follows:

(i) $50,000 on or before the date that is ten (10) calendar days after May 9, 2023 (the Effective Date”); (ii) $25,000 on or before: (A) the date that Collective consummates an equity investor financing providing not less than $200,000 in gross cash proceeds to Collective; or (B) December 1, 2023, whichever is earlier; (iii) $100,000 on or before the date that is one (1) calendar year after the Effective Date; (iv) $162,500 on or before the date that is two (2) calendar years after the Effective Date; and (v) $162,500 on or before the date that is three (3) calendar years after the Effective Date;

(b) issuing to Tulmeen an aggregate of 7,000,000 common shares (“Shares”) as follows:

(i) 1,000,000 Shares on or before the date that is ten (10) calendar days after the Effective Date; (ii) 1,500,000 Shares on or before the date that is one (1) calendar year after the Effective Date; (iii) 2,000,000 Shares on or before the date that is two (2) calendar years after the Effective Date; and (iv) 2,500,000 Shares on or before the date that is three (3) calendar years after the Effective Date; and

(c) incurring a minimum of $1,400,000 in exploration expenditures on the Project as follows:

(i) $300,000 on or before the date that is sixteen (16) months after the Effective Date, $85,000 of which must be incurred before June 30, 2023; (ii) $300,000 on or before the date that is two (2) calendar years after the Effective Date; (iii) $300,000 on or before the date that is three (3) calendar years after the Effective Date; and (iv) $500,000 on or before the date that is four (4) calendar years after the Effective Date.

Marketing Campaign

The Company announces an agreement with Hillside Consulting & Media Inc. (“Hillside”) (Address: 474 Main St, Penticton BC, Canada) (Phone: 250-485-3615; Email: hillsideconsultingmedia@gmail.com) for marketing services of up to 3 months, commencing May 9, 2023.

Hillside will utilize their online programs to generate a greater following, increase investor awareness and attract potential new investors through various online platforms and methods of engagement for total consideration of CDN$200,000. The activities will occur by email, online publications, social media and other PPC advertising techniques (the “Services”). As of the date hereof, to the Company’s knowledge, Hillside (including its directors and officers) does not own any securities of the Company and has an arm’s length relationship with the Company. The Company will not issue any securities to Hillside as compensation for its marketing services.

Options Issuance

The Company also announces that it has granted an aggregate of 2,475,000 incentive stock options (“Options”) under the Company’s stock option plan, each with an exercise price of CDN$0.15, to officers, directors and consultants of the Company. Each option, upon payment of the exercise price, entitles the holder thereof to receive one Share of the Company. The Options, and any Shares issued upon the exercise of, will be subject to a hold period of four months in accordance with the policies of the Canadian Securities Exchange.

Correction Notice of Press Release dated March 24, 2023 – Announcing Closing of Non-Brokered Private Placement of Units (the “Prior Release”)

The second paragraph of the Prior Release is corrected to read as follows. For clarity, the Company’s right to accelerate the expiry date of the warrants described therein will apply from closing of the Offering (defined in the Prior Release), instead of starting four-months and one day from closing (as previously indicated in the Prior Release):

“Each Unit consists of one common share in the capital of the Company (a “Share”) and one whole common share purchase warrant (a “Warrant”). Each Warrant entitles the holder to purchase one additional Share at a price of $0.20 on or before March 23, 2025 (the “Expiry Day”). The Warrants are subject to an acceleration clause such that, if the price at which the Shares trade on the Canadian Securities Exchange is greater than $0.30 for 10 consecutive trading days, the Company may accelerate the Warrant expiry date by giving notice to the holder of the Warrants. In such case, the Warrants will expire at 5:00 p.m. (Toronto time) on the date which is the earlier of: (i) the 30th day after the date on which such notice is given by the Company; and (ii) the Expiry Day.”

Qualified Person

This news release has been reviewed and approved by Rick Walker, P. Geo., who is acting as the Company’s Qualified Person for the Princeton Property project, in accordance with regulations under NI 43-101.

About Collective Metals:

Collective Metals Inc. (CSE: COMT | FSE: TO1) is a resource exploration company specialized in precious metals exploration in North America. The Company’s flagship property is the Princeton Project, located in south-central British Columbia, Canada, approximately 10 km west of the currently producing Copper Mountain Mine. The Princeton Project consists of 29 mineral tenures totaling approximately 28,560 ha (70,570 acres) in a well documented and prolific copper-gold porphyry belt and is easily accessible by road, located immediately west of Highway 3.

The Company’s Landings Lake Lithium Project, which is located in northwestern Ontario where numerous lithium deposits have been delineated to host significant reserves of Li2O. The Landings Lake Lithium Project is located 53 km east of Ear Falls, Ontario and covers 3,146 hectares.

Collective Metals is also advancing the Uptown Gold Project 4 km outside of Yellowknife, adjacent to several high grade past producing mines. The Uptown Gold Property is a high-grade Archean lode gold prospect adjoining the Giant Mine in Yellowknife, Northwest Territories. The property consists of 4 claims covering over 2,000 hectares and borders the west side of the Giant Mine leases.

On Behalf of Collective Metals Inc.

Christopher Huggins

Chief Executive Officer

T: 604-968-4844

E: chris@collectivemetalsinc.com

Forward Looking Information

Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as “may”, “expect”, “estimate”, “anticipate”, “intend”, “believe” and “continue” or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, and dependence on key personnel. Forward looking statements in this news release include, but are not limited to, statements respecting: completion of the Acquisition; the Company’s anticipated work program at the Project; and provision of the Services by Hillside. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, failure of counterparties to perform their contractual obligations, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release.